Our Crypto Tax Guide will help you to get organized, understand how the IRS taxes cryptocurrency as well as give you the current taxation rates for capital gains.

How to Prepare your Crypto Taxes:

1. Get the market value of the cryptocurrency on the day it was bought/ sold to calculate your profit/ loss.

2. Determine the correct taxable event.

-Sold a cryptocurrency in exchange for currency (US Dollars).

-Converted one cryptocurrency to another (for instance Bitcoin to Ethereum).

-Paid for products or services via cryptocurrency.

-Received cryptocurrency through an airdrop.

-Received cryptocurrency as a result of hard forks.

3. Determine the tax basis, whether you have a net gain or net loss.

4. Provision for Bitcoin loss.

-Any loss incurred on cryptocurrency can be used for offsetting capital gains. Losses that do not apply to offset capital gains are deductible from other kinds of income. This has a fixed limit of $3000. There are provisions to carry forward losses as well.

5. Reporting of income and capital gains and losses.

-You will report income coming from cryptocurrencies on Form 1040, Schedule D.

-Form 8949 D is used for reporting the disposal and sale of capital assets.

6. Correcting and classifying transactions.

-Cryptocurrency received as a payment is reported as regular income and incurs Federal and State taxes.

-Coins that are mined, derived by airdrop or hard-fork are taxed as ordinary income.

-Coins that are purchased for an investment and sold at a profit are taxed depending on the holding period. (If it is <1-year, it’s taxed as ordinary income. If the holding period is >1-year, then it’s treated as capital gains with a 3.8% additional tax on the investment income.)

-Holding cryptocurrency > 1- year attracts capital gain taxes, which can vary from 0% to 20% as per the tax bracket. On the other hand, cryptocurrency held < 1-year attracts tax around a 40% rate.

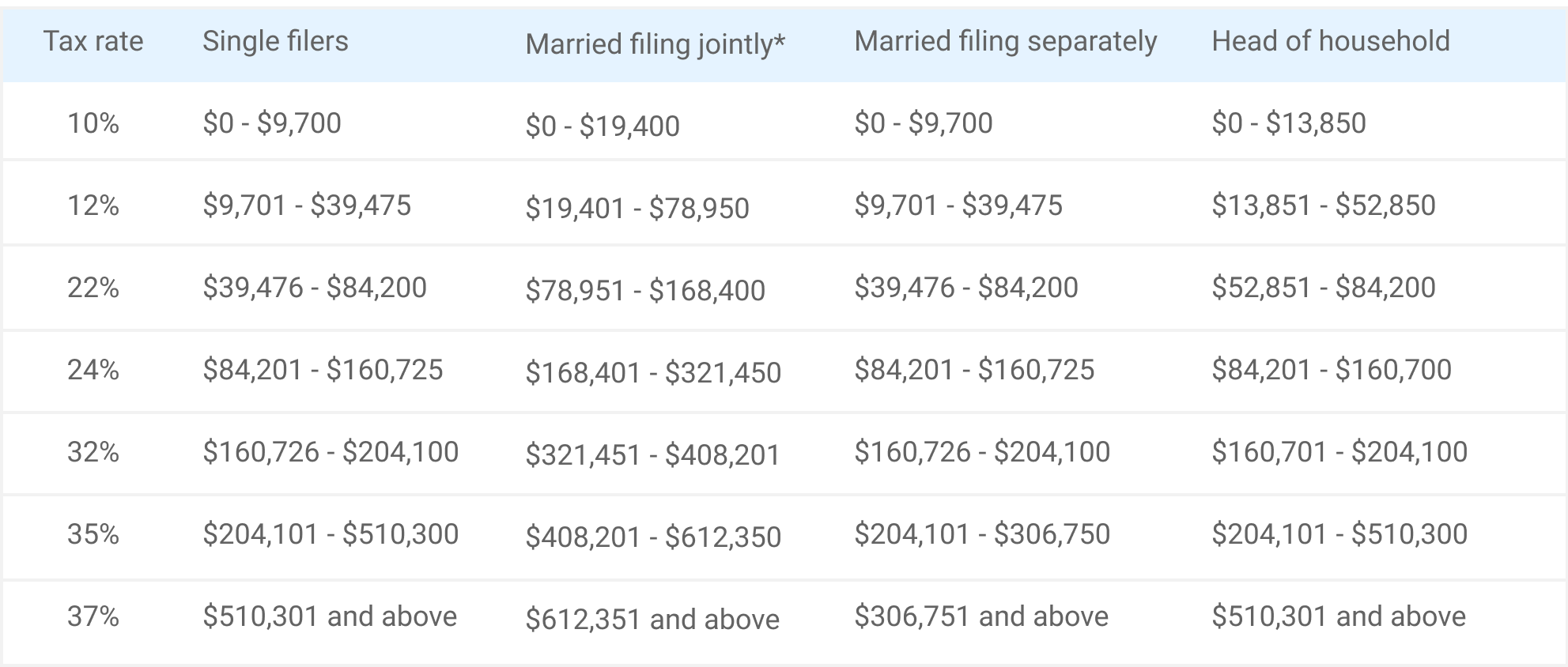

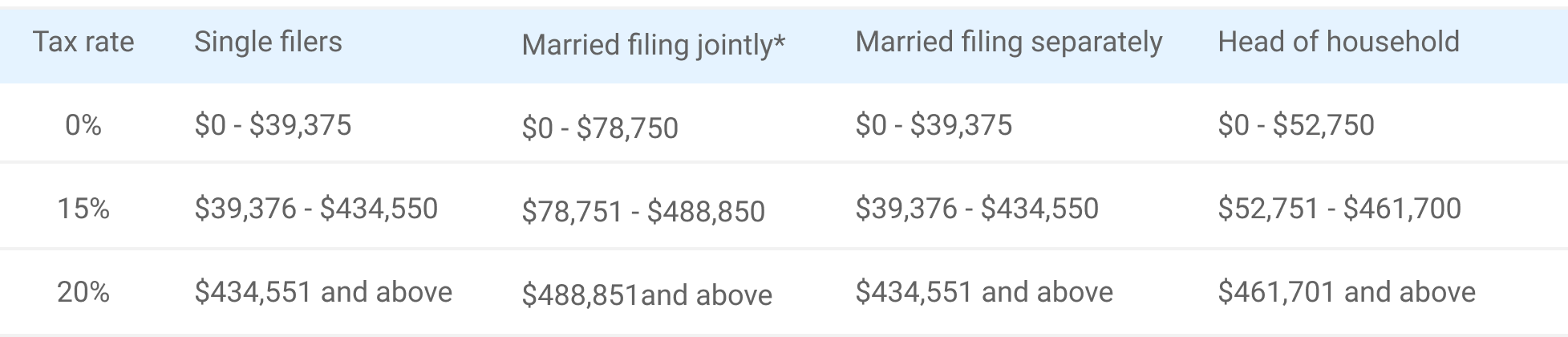

2020 IRS Tax Rates for Cryptocurrencies:

Below are the taxation charts for short-term and long-term holdings.

Short Term Holding Tax Brackets (<1-year)

Long Term Holding Tax Brackets (>1-year)

Be the first to comment